Understanding Atal Pension Yojana: A Path to Secure Retirement

Table of Contents:

- Introduction

- What is Atal Pension Yojana?

- Eligibility and Account Opening

- Contribution and Pension Amount

- Benefits of Atal Pension Yojana

- Application Process

- Withdrawal and Exit Rules

- Tax Benefits

- Conclusion

Introduction:

Planning for a secure retirement is a vital aspect of financial wellbeing. Atal Pension Yojana (APY) is a government-backed pension scheme designed to provide financial stability to the unorganized sector workers in India during their retirement years. In this comprehensive guide, we will explore the details of Atal Pension Yojana, its eligibility criteria, contribution structure, benefits, application process, withdrawal rules, and the tax benefits it offers.

What is Atal Pension Yojana?

Atal Pension Yojana is a pension scheme launched by the Government of India in 2015 under the National Pension System (NPS). It aims to provide a sustainable pension for workers in the unorganized sector, especially those who don't have access to formal pension plans. APY ensures that individuals can secure a fixed monthly pension amount after their retirement to maintain their financial independence.

Eligibility and Account Opening:

APY is open to all Indian citizens between the ages of 18 and 40. To open an APY account, individuals need to have a valid savings bank account and a valid Aadhaar card linked to their bank account. The enrollment process is straightforward and can be done through designated banks or post offices that are authorized to offer the scheme.

Contribution and Pension Amount:

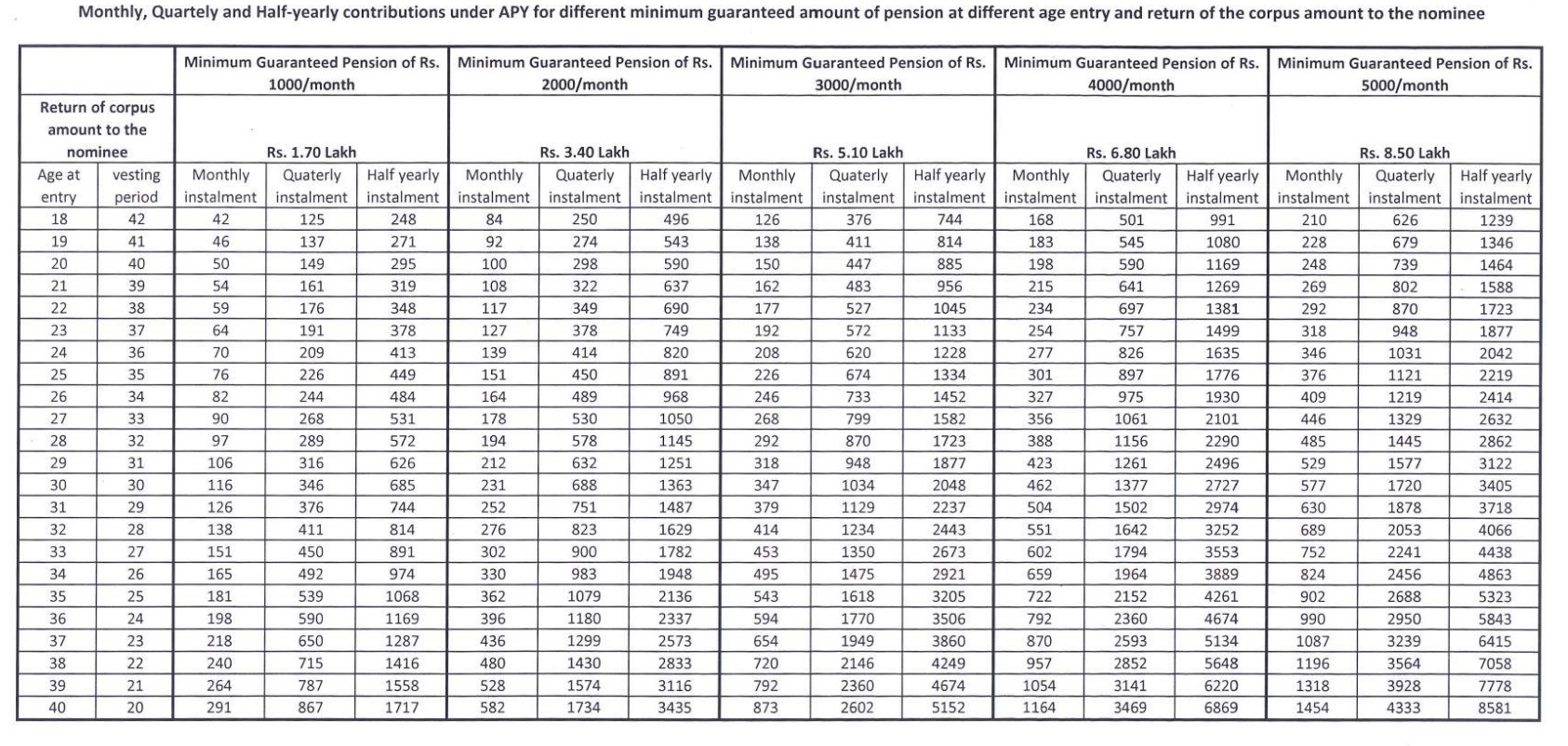

The contribution towards APY depends on the age of the subscriber and the desired pension amount. The scheme offers pension options ranging from Rs. 1,000 to Rs. 5,000 per month. The contribution varies based on the chosen pension amount and age at entry. Younger individuals are required to contribute less compared to those who enroll at a later age.

Benefits of Atal Pension Yojana:

APY offers several benefits to its subscribers, including:

- Guaranteed monthly pension after retirement

- Government co-contribution for eligible subscribers

- Flexible contribution options - monthly, quarterly, or half-yearly

- Death and disability benefits for beneficiaries

Application Process:

To apply for APY, visit your bank branch or designated post office. Fill out the application form, provide necessary documents, and provide details about your chosen pension amount and contribution frequency. Once enrolled, your contributions will be automatically debited from your linked savings account.

Withdrawal and Exit Rules:

Subscribers can start receiving the pension from the age of 60. In case of the subscriber's demise, the accumulated pension wealth is transferred to the spouse. Exit before the age of 60 is possible, but only under certain circumstances such as death or terminal illness.

Tax Benefits:

Contributions made towards APY are eligible for tax benefits under Section 80CCD of the Income Tax Act. The pension received is treated as income and is taxable in the hands of the subscriber.

Conclusion:

Atal Pension Yojana is a commendable initiative by the Indian government to ensure financial security for individuals in the unorganized sector during their retirement years. By offering a structured pension scheme with affordable contributions, APY aims to alleviate concerns about retirement planning. Consider exploring this scheme to pave the way for a secure and comfortable retirement.

Disclaimer: The information provided in this blog post is for general informational purposes only and should not be considered as professional advice. The schemes features, rules, and regulations may be subject to change, and readers are encouraged to verify the latest information from official sources or consult financial experts before making any investment decisions. The author and the website shall not be held liable for any losses or damages arising from the use of the information provided in this blog post.